How to bank the non-bankable

Non-bankable assets (nBAs), such as real estate, private equity, classic cars or any other rare collectibles, are often managed separately from financial assets, such as shares or bonds. Investing in nBAs, accounting for almost one third of global private wealth, often comes with high entry barriers for investors while providing significant investment opportunities.

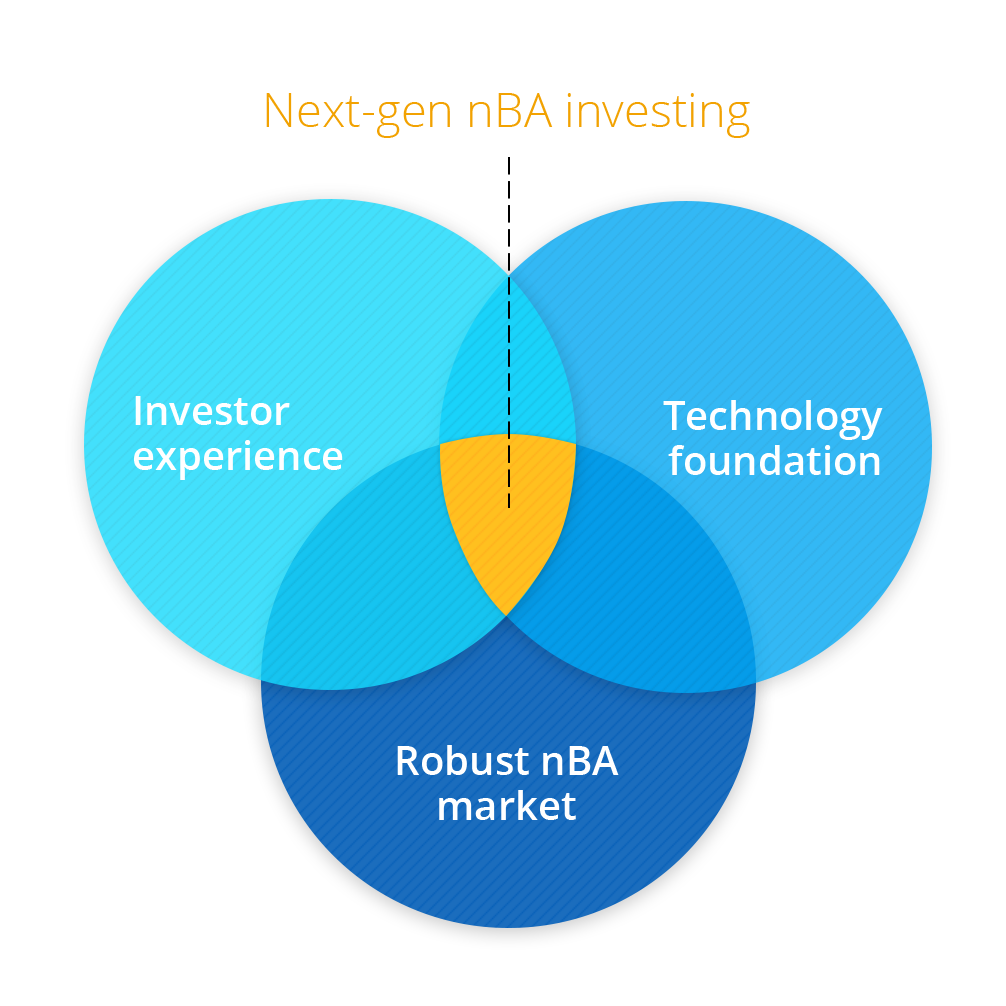

Before non-bankable assets find their way into wealth management at scale, there are some challenges to overcome. The first has to do with valuing nBAs and their potential risk and return for seamless inclusion in a traditional portfolio. The second is around making nBAs accessible and creating liquid markets. And, lastly, the decision for a newly formed business model - the investing in tokenized nBAs - has to be taken and a platform on which to run it must be developed.